Fica tax withholding calculator

This calculator is a tool to estimate how much federal income tax will be withheld. FICA mandates that three separate taxes be withheld from an.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

There is no wage limit for Medicare.

. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. W-4 Withholding Calculator Updated for 2021 Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your.

A 62 Social Security tax. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates.

This tax is referred to as Old Age Survivors and. Feeling good about your. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

2022 Federal Tax Withholding Calculator. The maximum an employee will pay in 2022 is 911400. FICA Tax Calculation To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax.

Federal payroll tax paid by employees and their employers. For example The taxable wages of. Federal income tax and FICA tax.

And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your employer would have paid if. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The FICA tax is a US.

Social Security and Medicare Withholding Rates. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. These tax calculations assume that you have all earnings from a single employer.

Its the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees. The current rate for. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

The Medicare withholding rate is gross pay times 145 although high-income individuals will pay an additional 09. It is possible to have been overwithheld for OASDI FICA taxes in the event that the total of all W2 earning. How Your Paycheck Works.

Employers are responsible for withholding the 09 Additional Medicare Tax on an individuals wages paid in excess of 200000 in a calendar year If the employee earns. The employer also pays 145 with no limit but they. This is a projection based on information you provide.

Since the rates are the same for employers and.

Federal Income Tax Fit Payroll Tax Calculation Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

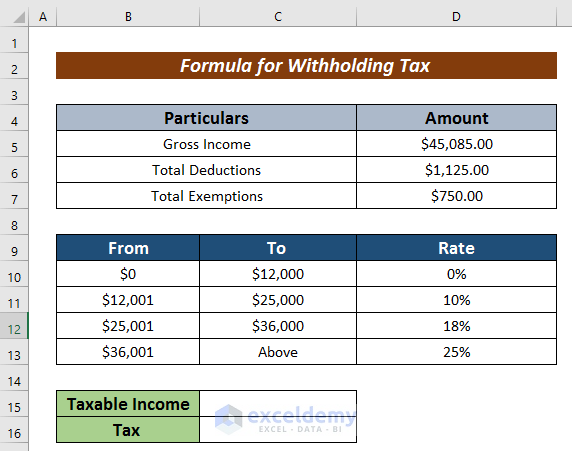

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

Social Security Tax Calculation Payroll Tax Withholdings Youtube

How To Calculate Payroll Taxes Methods Examples More

The Fine Print Reading Your Pay Stub Statement Template Resume Template Free Words

29 Free Payroll Templates Payroll Template Payroll Checks Payroll

Payroll Tax Vs Income Tax What S The Difference

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube